Indicators on Paul B Insurance You Should Know

Wiki Article

Our Paul B Insurance PDFs

Table of ContentsNot known Incorrect Statements About Paul B Insurance The Ultimate Guide To Paul B InsuranceThe smart Trick of Paul B Insurance That Nobody is DiscussingHow Paul B Insurance can Save You Time, Stress, and Money.Unknown Facts About Paul B Insurance

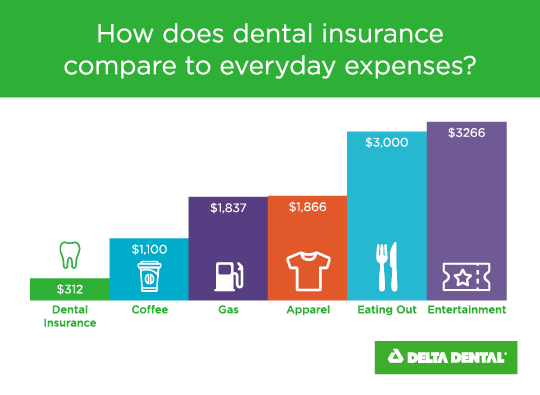

The thought is that the money paid out in cases gradually will be much less than the overall premiums accumulated. You may seem like you're tossing cash out the home window if you never sue, but having item of mind that you're covered in the event that you do suffer a significant loss, can be worth its weight in gold.Imagine you pay $500 a year to guarantee your $200,000 home. This indicates you have actually paid $5,000 for home insurance policy.

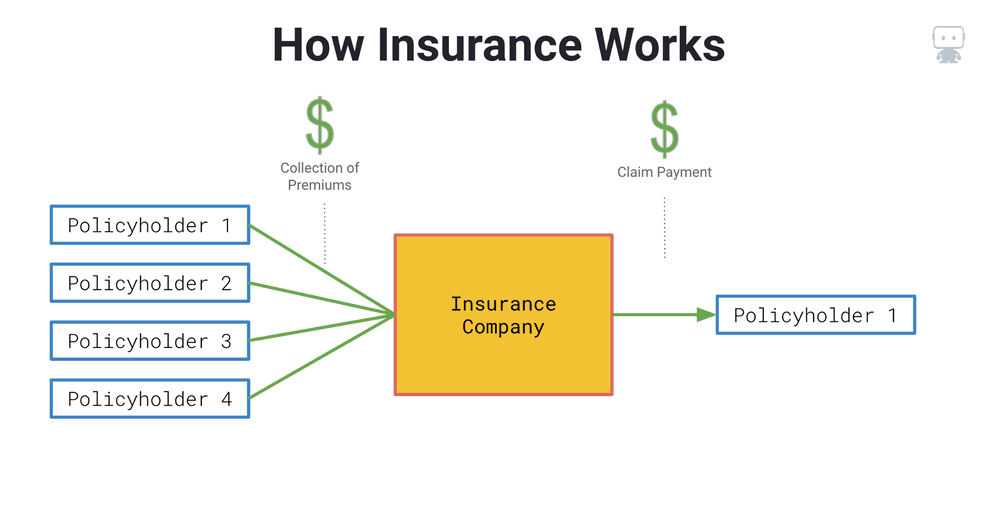

Because insurance is based on spreading out the danger amongst lots of individuals, it is the pooled cash of all individuals paying for it that allows the company to construct properties and cover insurance claims when they happen. Insurance policy is a service. It would certainly be great for the companies to simply leave rates at the exact same degree all the time, the fact is that they have to make enough cash to cover all the prospective cases their policyholders might make.

Paul B Insurance Fundamentals Explained

just how much they entered premiums, they must modify their rates to generate income. Underwriting adjustments and rate rises or declines are based upon results the insurer had in previous years. Relying on what business you acquire it from, you might be handling a restricted representative. They sell insurance coverage from just one business.The frontline individuals you deal with when you purchase your insurance coverage are the agents as well as brokers that represent the insurance policy company. They a familiar with that firm's products or offerings, but can not talk in the direction of other business' plans, pricing, or item offerings.

A Biased View of Paul B Insurance

The insurance you require differs based upon where you go to in your life, what sort of possessions you have, as well as what your long term goals and obligations are. That's why it is essential to put in the time to review what you want out of your policy with your representative.If you obtain a car loan to buy a vehicle, and afterwards something occurs to the automobile, gap insurance coverage will repay any section of your lending that standard vehicle insurance coverage doesn't cover. Some lending institutions require their borrowers to lug space insurance.

The Definitive Guide to Paul B Insurance

Life insurance coverage covers the life of the insured person. The insurance holder, who can be a different individual or entity from the guaranteed, pays premiums to an insurance policy company. In return, the insurance firm pays out a sum of cash to the recipients listed on the policy. Term life insurance policy covers you for a time period selected at acquisition, such as 10, 20 or 30 years.Term life is preferred due to the fact that it offers huge payments at a reduced price than irreversible life. There are some variants of typical term life insurance policies.

Permanent life insurance policy policies build cash worth as they age. The money value of entire life insurance policy policies grows at a set rate, while the cash money worth within universal plans can change.

The Ultimate Guide To Paul B Insurance

$500,000 of whole life coverage for a healthy and balanced 30-year-old female costs around $4,015 every year, on average. That very same level of protection with a 20-year term life plan would certainly cost a standard of concerning $188 every year, according to Quotacy, a broker agent firm.useful reference

Variable life is an additional long-term life insurance coverage choice. It's an alternate to whole life with a fixed payout.

Here are some life insurance essentials to assist you better understand just how insurance coverage functions. For term life policies, these cover the expense of your insurance and also management costs.

Report this wiki page